Saving texas instruments calculator. Finest Selection of texas instruments calculator. Sale on Now.

Sunday, December 25, 2011

TI-83 & 84 Plus BASIC RPG Nostalgia Part 16 - The Legend Of Zelda: Dark Link Quest - Various clips

Wednesday, December 21, 2011

Devrays - Shoot'em Up for TI83+/TI84+ Calculators

Frye Boots Engineer Top Quality Prices Keurig Repairs Uttermost Floor Lamps Best

Saturday, December 17, 2011

Mergers and Acquisition - A Case Study and Analysis of HP-Compaq Merger

Brief Description

The following is a brief description of the two companies:

HP

It all began in the year 1938 when two electrical engineering graduates from Stanford University called William Hewlett and David Packard started their business in a garage in Palo Alto. In a year's time, the partnership called Hewlett-Packard was made and by the year 1947, HP was incorporated. The company has been prospering ever since as its profits grew from five and half million dollars in 1951 to about 3 billion dollars in 1981. The pace of growth knew no bounds as HP's net revenue went up to 42 billion dollars in 1997. Starting with manufacturing audio oscillators, the company made its first computer in the year 1966 and it was by 1972 that it introduced the concept of personal computing by a calculator first which was further advanced into a personal computer in the year 1980. The company is also known for the laser-printer which it introduced in the year 1985.

Compaq

The company is better known as Compaq Computer Corporation. This was company that started itself as a personal computer company in the year 1982. It had the charm of being called the largest manufacturers of personal computing devices worldwide. The company was formed by two senior managers at Texas Instruments. The name of the company had come from-"Compatibility and Quality". The company introduced its first computer in the year 1983 after at a price of 2995 dollars. In spite of being portable, the problem with the computer was that it seemed to be a suitcase. Nevertheless, there were huge commercial benefits from the computer as it sold more than 53,000 units in the first year with a revenue generation of 111 million dollars.

Reasons for the Merger

A very simple question that arises here is that, if HP was progressing at such a tremendous pace, what was the reason that the company had to merge with Compaq? Carly Fiorina, who became the CEO of HP in the year 1999, had a key role to play in the merger that took place in 2001. She was the first woman to have taken over as CEO of such a big company and the first outsider too. She worked very efficiently as she travelled more than 250,000 miles in the first year as a CEO. Her basic aim was to modernize the culture of operation of HP. She laid great emphasis on the profitable sides of the business. This shows that she was very extravagant in her approach as a CEO. In spite of the growth in the market value of HP's share from 54.43 to 74.48 dollars, the company was still inefficient. This was because it could not meet the targets due to a failure of both company and industry. HP was forced to cut down on jobs and also be eluded from the privilege of having Price Water House Cooper's to take care of its audit. So, even the job of Fiorina was under threat. This meant that improvement in the internal strategies of the company was not going to be sufficient for the company's success. Ultimately, the company had to certainly plan out something different. So, it was decided that the company would be acquiring Compaq in a stock transaction whose net worth was 25 billion dollars. Initially, this merger was not planned. It started with a telephonic conversation between CEO HP, Fiorina and Chairman and CEO Compaq, Capellas. The idea behind the conversation was to discuss on a licensing agreement but it continued as a discussion on competitive strategy and finally a merger. It took two months for further studies and by September, 2001, the boards of the two companies approved of the merger. In spite of the decision coming from the CEO of HP, the merger was strongly opposed in the company. The two CEOs believed that the only way to fight the growing competition in terms of prices was to have a merger. But the investors and the other stakeholders thought that the company would never be able to have the loyalty of the Compaq customers, if products are sold with an HP logo on it. Other than this, there were questions on the synchronization of the organization's members with each other. This was because of the change in the organization culture as well. Even though these were supposed to serious problems with respect to the merger, the CEO of HP, Fiorina justified the same with the fact that the merger would remove one serious competitor in the over-supplied PC market of those days. She said that the market share of the company is bound to increase with the merger and also the working unit would double. (Hoopes, 2001)

Advantages of the Merger

Even though it seemed to be advantageous to very few people in the beginning, it was the strong determination of Fiorina that she was able to stand by her decision. Wall Street and all her investors had gone against the company lampooning her ideas with the saying that she has made 1+1=1.5 by her extravagant ways of expansion. Fiorina had put it this way that after the company's merger, not only would it have a larger share in the market but also the units of production would double. This would mean that the company would grow tremendously in volume. Her dream of competing with the giants in the field, IBM would also come true. She was of the view that much of the redundancy in the two companies would decrease as the internal costs on promotion, marketing and shipping would come down with the merger. This would produce the slightest harm to the collection of revenue. She used the ideas of competitive positioning to justify her plans of the merger. She said that the merger is based on the ideologies of consolidation and not on diversification. She could also defend allegations against the change in the HP was. She was of the view that the HP has always encouraged changes as it is about innovating and taking bold steps. She said that the company requires being consistent with creativity, improvement and modification. This merger had the capability of providing exactly the same. (Mergers and Acquisitions, 2010)

Advantages to the Shareholders

The following are the ways in which the company can be advantageous to its shareholders:

Unique Opportunity: The position of the enterprise is bound to better with the merger. The reason for the same was that now the value creation would be fresh, leadership qualities would improve, capabilities would improve and so would the sales and also the company's strategic differentiation would be better than the existing competitors. Other than this, one can also access the capabilities of Compaq directly hence reducing the cost structure in becoming the largest in the industry. Finally, one could also see an opportunity in reinvesting.

Stronger Company: The profitability is bound to increase in the enterprise, access and services sectors in high degrees. The company can also see a better opportunity in its research and development. The financial conditions of the company with respect to its EBIT and net cash are also on the incremental side.

Compelling Economics: The expected accumulation in IIP gains would be 13% in the first financial year. The company could also conduct a better segmentation of the market to forecast its revenues generation. This would go to as much as 2 and a half billion dollars of annual synergy.

Ability to Execute: As there would be integration in the planning procedures of the company, the chances of value creation would also be huge. Along with that the experience of leading a diversified employee structure would also be there. (HP to buy Compaq, 2001)

Opposition to the Merger

In fact, it was only CEO Fiorina who was in favor of going with the merger. This is a practical application of Agency problem that arises because of change in financial strategies of the company owners and the management. Fiorina was certain to lose her job if the merger didn't take effect. The reason was that HP was not able to meet the demand targets under her leadership. But the owners were against the merger due to the following beliefs of the owners:

The new portfolio would be less preferable: The position of the company as a larger supplier of PCs would certainly increase the amount of risk and involve a lot of investment as well. Another important reason in this context is that HP's prime interest in Imaging and Printing would not exist anymore as a result diluting the interest of the stockholders. In fact the company owners also feel that there would be a lower margin and ROI (return on investment).

Strategic Problems would remain Unsolved: The market position in high-end servers and services would still remain in spite of the merger. The price of the PCS would not come down to be affordable by all. The requisite change in material for imaging and printing also would not exist. This merger would have no effect on the low end servers as Dell would be there in the lead and high-end servers either where IBM and Sun would have the lead. The company would also be eluded from the advantages of outsourcing because of the surplus labor it would have. So, the quality is not guaranteed to improve. Finally, the merger would not equal IBM under any condition as thought by Fiorina.

Huge Integrated Risks: There have been no examples of success with such huge mergers. Generally when the market doesn't support such mergers, don't do well as is the case here. When HP could not manage its organization properly, integration would only add on to the difficulties. It would be even more difficult under the conditions because of the existing competitions between HP and Compaq. Being prone to such risky conditions, the company would also have to vary its costs causing greater trouble for the owner. The biggest factor of all is that to integrate the culture existing in the two companies would be a very difficult job.

Financial Impact: This is mostly because the market reactions are negative. On the other hand, the position of Compaq was totally different from HP. As the company would have a greater contribution to the revenue and HP being diluted at the same time, the problems are bound to develop. This would mean that drawing money from the equity market would also be difficult for HP. In fact this might not seem to be a very profitable merger for Compaq as well in the future.

The basic problem that the owners of the company had with this merger was that it would hamper the core values of HP. They felt that it is better to preserve wealth rather than to risk it with extravagant risk taking. This high risk profile of Fiorina was a little unacceptable for the owners of the company in light of its prospects.

So, as far as this merger between HP and Compaq is concerned, on side there was this strong determination of the CEO, Fiorina and on the other side was the strong opposition from the company owners. This opposition continued from the market including all the investors of the company. So, this practical Agency problem was very famous considering the fact that it contained two of the most powerful hardware companies in the world. There were a number of options like Change Management, Economic wise Management, and Organizational Management which could be considered to analyze the issue. But this case study can be solved best by a strategy wise analysis. (HP-Compaq merger faces stiff opposition from shareholders stock prices fall again, 2001)

Strategic Analysis of the Case

Positive Aspects

A CEO will always consider such a merger to be an occasion to take a competitive advantage over its rivals like IBM as in this case and also be of some interest to the shareholders as well. The following are the strategies that are related to this merger between HP and Compaq:

* Having an eye over shareholders' value: If one sees this merger from the eyes of Fiorina, it would be certain that the shareholders have a lot to gain from it. The reason for the same is the increment in the control of the market. So, even of the conditions were not suitable from the financial perspective, this truth would certainly make a lot of profits for the company in the future.

* Development of Markets: Two organizations get involved in mergers as they want to expand their market both on the domestic and the international level. Integration with a domestic company doesn't need much effort but when a company merges internationally as in this case, a challenging task is on head. A thorough situation scanning is significant before putting your feet in International arena. Here, the competitor for HP was Compaq to a large degree, so this merger certainly required a lot of thinking. Organizations merge with the international companies in order to set up their brands first and let people know about what they are capable of and also what they eye in the future. This is the reason that after this merger the products of Compaq would also have the logo of HP. Once the market is well-known, then HP would not have to suffer the branding created by Compaq. They would be able to draw all the customers of Compaq as well.

* Propagated Efficiencies: Any company by acquiring another or by merging makes an attempt to add to its efficiencies by increasing the operations and also having control over it to the maximum extent. We can see that HP would now have an increased set of employees. The only factor is that they would have to be controlled properly as they are of different organizational cultures. (Benefits of Mergers:, 2010)

* Allowances to use more resources: An improvised organization of monetary resources, intellectual capital and raw materials offers a competitive advantage to the companies. When such companies merge, many of the intellects come together and work towards a common mission to excel with financial profits to the company. Here, one can't deny the fact that even the top brains of Compaq would be taking part in forming the strategies of the company in the future.

* Management of risks: If we particularly take an example of this case, HP and Compaq entering into this merger can decrease the risk level they would have diversified business opportunities. The options for making choice of the supply chain also increase. Now even though HP is a pioneer in inkjet orienting, it would not have to use the Product based Facility layout which is more expensive. It can manage the risk of taking process based facility layout and make things cheaper. Manufacturing and Processing can now be done in various nations according to the cost viability as the major issue.

* Listing potential: Even though Wall Street and all the investors of the company are against the merger, when IPOs are offered, a development will definitely be there because of the flourishing earnings and turnover value which HP would be making with this merger.

* Necessary political regulations: When organizations take a leap into other nations, they need to consider the different regulations in that country which administer the policies of the place. As HP is already a pioneer in all the countries that Compaq used to do its business, this would not be of much difficulty for the company. The company would only need to make certain minor regulations with the political parties of some countries where Compaq was flourishing more than HP.

* Better Opportunities: When companies merge with another company, later they can put up for sale as per as the needs of the company. This could also be done partially. If HP feels that it would not need much of warehouse space it can sell the same at increased profits. It depends on whether the company would now be regarded a s a make to stock or a make to order company.

* Extra products, services, and facilities: Services get copyrights which enhances the level of trade. Additional Warehouse services and distribution channels offer business values. Here HP can use all such values integrated with Compaq so as to increase its prospects. (Berry, 2010)

Negative Aspects

There are a number of mergers and acquisitions that fail before they actually start to function. In the critical phase of implementation itself, the companies come to know that it would not be beneficial if they continue as a merger. This can occur in this merger between HP and Compaq due to the following reasons.

Conversations are not implemented: Because of unlike cultures, ambitions and risk profiles; many of the deals are cancelled. As per as the reactions of the owners of HP, this seems to be extremely likely. So, motivation amongst the employees is an extremely important consideration in this case. This requires an extra effort by the CEO, Fiorina. This could also help her maintain her position in the company.

Legal Contemplations: Anti-competitive deals are often limited by the rules presiding over the competition rules in a country. This leads to out of order functioning of one company and they try to separate from each other. A lot of unnecessary marketing failures get attached to these conditions. If this happens in this case, then all that money which went in publicizing the venture would go to be a waste. Moreover, even more would be required to re-promote as a single entity. Even the packaging where the entire inventory from Compaq had the logo of HP would have to be re-done, thus hampering the finance even further. (Broc Romanek, 2002)

Compatibility problems: Every company runs on different platforms and ideas. Compatibility problems often occur because of synchronization issues. In IT companies such as HP and Compaq, many problems can take place because both the companies have worked on different strategies in the past. Now, it might not seem necessary for the HP management to make changes as per as those from Compaq. Thus such problems have become of greatest concern these days.

Fiscal catastrophes: Both the companies after signing an agreement hope to have some return on the money they have put in to make this merger happen and also desire profitability and turnovers. If due to any reason, they are not able to attain that position, then they develop a abhorrence sense towards each other and also start charging each other for the failure.

Human Resource Differences: Problems as a result of cultural dissimilarities, hospitality and hostility issues, and also other behavior related issues can take apart the origin of the merger.

Lack of Determination: When organizations involve, they have plans in their minds, they have a vision set; but because of a variety of problems as mentioned above, development of the combined company to accomplish its mission is delayed. Merged companies set the goal and when the goal is not accomplished due to some faults of any of the two; then both of them develop a certain degree of hatred for each other. Also clashes can occur because of bias reactions. (William, 2008)

Risk management failure: Companies that are involved in mergers and acquisitions, become over confident that they are going to make a profit out of this decision. This can be seen as with Fiorina. In fact she can fight the whole world for that. When their self-confidence turns out into over-confidence then they fail. Adequate risk management methods should be adopted which would take care of the effects if the decision takes a downturn. These risk policies should rule fiscal, productions, marketing, manufacturing, and inventory and HR risks associated with the merger.

Strategic Sharing

Marketing

Hp and Compaq would now have common channels as far as their buying is concerned. So, the benefits in this concern is that even for those materials which were initially of high cost for HP would now be available at a cheaper price. The end users are also likely to increase. Now, the company can re frame its competitive strategy where the greatest concern can be given to all time rivals IBM. The advantages of this merger in the field of marketing can be seen in the case of shared branding, sales and service. Even the distribution procedure is likely to be enhanced with Compaq playing its part. Now, the company can look forward to cross selling, subsidization and also a reduced cost.

Operations

The foremost advantage in this area is that in the location of raw material. Even the processing style would be same making the products and services synchronized with the ideas and also in making a decent operational strategy. As the philosophical and mechanical control would also be in common, the operational strategy would now be to become the top most in the market. In this respect, the two companies would now have co-production, design and also location of staff. So, the operational strategy of HP would now be to use the process based facility layout and function with the mentioned shared values.

Technology

The technical strategy of the company can also be designed in common now. There is a disadvantage from the perspective of the differentiation that HP had in the field of inkjet printers but the advantages are also plentiful. With a common product and process technology, the technological strategy of the merged company would promote highly economical functioning. This can be done through a common research and development and designing team.

Buying

The buying strategy of the company would also follow a common mechanism. Here, the raw materials, machinery, and power would be common hence decreasing the cost once again. This can be done through a centralized mechanism with a lead purchaser keeping common policies in mind. Now Hp would have to think with a similar attitude for both inkjet printers as well as personal computers. This is because the parameters for manufacturing would also run on equal grounds.

Infrastructure

This is the most important part of the strategies that would be made after the merger. The companies would have common shareholders for providing the requisite infrastructure. The capital source, management style, and legislation would also be in common. So, the infrastructure strategies would have to take these things into account. This can be done by having a common accounting system. HP does have an option to have a separate accounting system for the products that it manufactures but that would only arouse an internal competition. So, the infrastructural benefits can be made through a common accounting, legal and human resource system. This would ensure that the investment relations of the company would improve. None of the Compaq investors would hesitate in making an investment if HP follows a common strategy.

HP would now have to ensure another fact that with this merger they would be able to prove competitors to the present target and those of competitors like IBM as well. Even the operations and the output market needs to be above what exists at present. The company needs to ensure that the corporate strategy that it uses is efficient enough to help such a future. The degree of diversification needs to be managed thoroughly as well. This is because; the products from the two companies have performed exceptionally well in the past. So, the most optimum degree of diversification is required under the context so that the company is able to meet the demands of the customers. This has been challenged by the owners of HP but needs to be carried by the CEO Fiorina. (Bhattacharya, 2010)

Diy Irrigation System Reviews Promotion L-arginine And L-citrulline

Monday, December 12, 2011

Retro review: TI-92

Biorhythm Compatibility Sale Saving Keurig K Cups Decaf Comparison Vigor Gaming

Thursday, December 8, 2011

Saturday, December 3, 2011

Classic Tetris - TI-84 Plus, TI-83 Plus - Graphing Calculator Games

Italian Roast Starbucks Discount Cheaper Scotch Atg Pink Frye Dorado Short Boot Save

Wednesday, November 30, 2011

Calculator Tutorial.mp4

Sunday, November 27, 2011

Mortgage Or Rent?

For many home buyers, the dilemma of whether to rent or to own is a common one. There are three benefits of home ownership. Firstly, home ownership produces one of the safest and surest opportunities to build your personal wealth assuming that the purchase is geared lightly. Secondly, property offers a potential source of capital preservation. Finally, home ownership yields non-financial benefits that far outweigh monetary returns and provide satisfaction to the owners.

Some people may have the notion that home ownership will no longer produce good financial returns because of the compounding effect of mortgages. However, not everyone has the discipline or skill to put a certain amount of money aside monthly to build up their wealth. The temptation to take out the profits for consumption may be too great to resist.

Maybe buying a home is the best way to commit yourself to save for the initial down payment. Then, by merely waiting until the total needed amount for your dream house is saved, most will end up not being able to fulfill their goals as they may not be disciplined enough to follow strictly their saving plan and also inflation may keep on eroding the purchasing power of money. Conversely, building wealth through home equity has consistently proven to be a prudent strategy as property values are more stable than other asset values.

Concerning the issue of wealth accumulation via home equity, homeowners have to consider if they are better off if they rent and put their extra money into saving. If the returns on other investment instruments are greater than the appreciation of the house prices, then by all means to continue in renting.

However, most homeowners spend less for housing than renters do. Even though the exact cost advantages will differ between towns and cities throughout the country, over time rents continue to increase as mortgage payments remain quite stable.

Moreover, after your mortgage is paid off, your monthly payments will be reduced to zero. This cost advantage of owning means that as the homeowners grow older, they will have more money left from their salaries after paying off the mortgage. Thus, they have more money for other purposes like children education and medical bills.

Aside from the possibility of financial gains, there are many more non-monetary benefits you can enjoy. When you buy your own home, you don't just buy a house, you also gain freedom. You are not only saving money each month and building wealth, but more importantly, you have escaped from the 'renters' jail'. By freeing yourselves from the 'renters' jail', there will be no more landlords to tell you how you can decorate, who you can have over, or whether you can get a cat or dog. For the first time in your life, you are free to do with the home the way you want. Even if the mortgage costs you more, it'd be worth.

Therefore, the financial returns of ownership are great, but the most important benefit of owning is ownership itself. Ownership gives you the feelings of security and comfort. When you rented, you will never felt in control of your life. So, when figuring out your rent versus mortgage comparisons, keep in mind the enhanced benefits of owning.

Kitchenaid Artisan Buy Online Dewalt Factory Service Clearance Sale

Thursday, November 24, 2011

5 Steps to Choose Your Financial Advisor

Before you settle on your financial advisor, make sure that you have weighed all your options. The internet is vast and would readily provide you with details and the contact information of financial specialists. Friends and acquaintances could also provide helpful leads in the matter.

1) Encourage to look into the details of maintenance

A good financial planner would encourage you to look into the details of maintenance as well as updating and implementation with periodic reviews of reports and correspondence. Pick the right specialist be it regarding tax advice and preparation, retirement planning stock and equity portfolios, investment strategies, personal budgeting and debt management, savings plans, estate planning, or insurance advice.

2) Check the authenticity of your advisor

A financial advisor needs to be licensed by IRDA in order to be equipped to deal in insurance and by AMFI to deal in mutual funds in India. Any extra qualification such as CFP would add more value to the advisor's portfolio. In addition to the qualifications, the advisor's experience in the profession as well as their exposure to financial dealings in recessionary times would speak for themselves.

Make sure you verify and are aware of the advisor's qualifications, previous financial deals and professional history. The information should give you a clear idea about how well versed with his profession he is.

3) References and information about his previous clientele

It is of prime importance that you gather references from clients who have dealt previously with your potential financial advisor. Not only will this give you a clear idea of his integrity and potential but will also prevent you from getting caught up in any glitches. Make sure that you have chosen the correct advisor to work with who specializes in the field that you desire. It is not a bad idea to take the time to go through the testimonials given to him by his prior clients.

4) Say No to Financial advisors who boast of huge returns

Avoid financial advisers who boast of enormous returns and high performances as they will only put your money in high risk situations. As they say, actions speak louder than words and it applies to this particular situation in a very obvious way. Do not base your opinions on what an advisor claims he can do to make your money grow. Instead, verify and check his documentation and past clientele records to validate his claims.

5) Compensation for services

There are a variety of ways in which an advisor can be compensated for his services. The charges could vary from hourly charges to a flat monthly fee. A percentage on the invested amount or a commission on the same. The compensation could also be based on the number of transactions. Other ways of payment could include a combination of two or more of the methods mentioned above.

Some of the financial advisors may charge you for a number of trades or, procuring commission from the investment companies. At times, these charges could be for personal profitable gains without keeping your best interests in mind.

Conclusion

Do not hold back any queries or questions when it comes to safeguarding your money. Be sure to be well versed with the working and the philosophy of your investment. Always cross-check the qualifications and reputation of your financial advisor. Stay alert and well informed. The results you could reap would be well worth it.

Sunday, November 20, 2011

Texas Instruments Voyage 200 Calculator

!±8± Texas Instruments Voyage 200 Calculator

| Price : $182.99

| Price : $182.99Post Date : Nov 21, 2011 00:11:37 | Usually ships in 24 hours

- QWERTY keyboard for typing

- Large easy-to-ready 128 x 240 pixel LCD

- Preloaded with popular applications, including The Geometer's Sketchpad

- Accepts StudyCards for history, foreign language, English, and more

- Numeric and symbolic equations; factor, solve, differentiate, integrate

More Specification..!!

Texas Instruments Voyage 200 Calculator

Discount Olay Regenerist Wholesale Asolo Backpacking Boots Promo Hozelock Pond Pump

Wednesday, November 16, 2011

Texas Instruments Ti-nspire Graphing Calculator with Touchpad

!±8±Texas Instruments Ti-nspire Graphing Calculator with Touchpad

Brand : Texas InstrumentsRate :

Price : $0.00

Post Date : Nov 16, 2011 11:48:37

Usually ships in 1-2 business days

The Texas Instruments Ti-nspire Graphing Calculator with Touchpad features Includes an easy-glide Touchpad that works more like a computer with a mouse, See multiple representations of a single problem - algebraic, graphical, geometric, numeric and written, Explore individual representations, one at a time, or as many as four on the same screen, Grab a graphed function and move it to see the effect on corresponding equations and data lists and Link representations - Manipulate the properties of one and observe instant updates to others without switching screens.

Small Glass Bottles With Corks Grand Sale Similac Isomil Formula Clearance Sale

Sunday, November 13, 2011

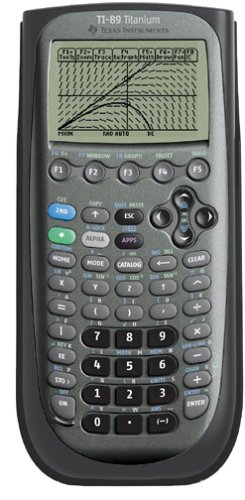

Texas Instruments TI-89 Titanium Graphing Calculator

!±8± Texas Instruments TI-89 Titanium Graphing Calculator

| Price : $136.88

| Price : $136.88Post Date : Nov 13, 2011 23:51:17 | Usually ships in 24 hours

- Graphing calculator handles calculus, algebra, matrices, and statistical functions

- 188 KB RAM and 2.7 MB flash memory for speed; plenty of storage for functions, programs, data

- Large 100 x 160 pixel display for split-screen views

- USB on-the-go technology for file sharing with other calculators and connecting with PCs

- Backed by 1-year warranty

- 188 KB RAM and 27 MB flash memory for speed; plenty of storage for functions, programs, data